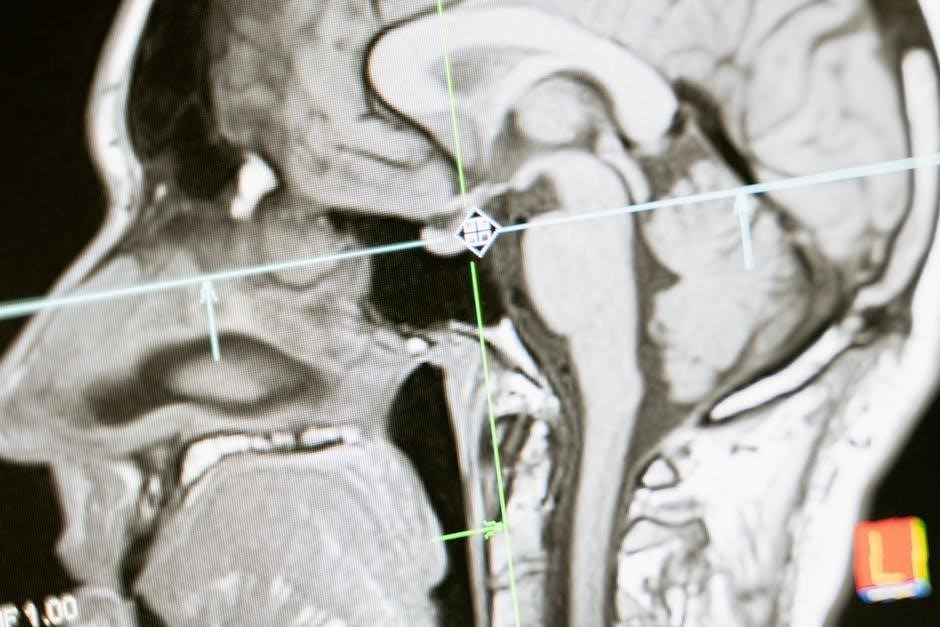

Brain anatomy, detailed in numerous textbooks and PDF resources, explores the complex structure of the organ.

Netter’s Atlas of Human Anatomy is a prime example, offering comprehensive visual guides.

Studying this field, as highlighted in recent publications like “Brain Biochemistry and its Disease”, is crucial for understanding neurological functions.

What is Brain Anatomy?

Brain anatomy is the study of the brain’s physical structure and organization. It encompasses everything from the macroscopic arrangement of lobes and regions to the microscopic details of neurons and synapses. Resources like downloadable PDF versions of classic textbooks, such as those referenced in the Air Medical Investigation Committee reports, provide foundational knowledge.

This field isn’t merely descriptive; it’s fundamentally linked to function. Understanding the precise location and connections of different brain areas – as detailed in resources like the Nobel Publishing’s “Brain Biochemistry and its Disease” – is essential for deciphering how the brain processes information, controls behavior, and generates consciousness.

The study utilizes various tools, including detailed atlases like Netter’s, and increasingly, online resources and simulators. These resources, including those found at ct2tee.agh.edu.pl, allow for interactive exploration of the brain’s intricate architecture. It’s a constantly evolving field, updated with the latest neuroscience discoveries.

Importance of Studying Brain Anatomy

Studying brain anatomy is paramount for numerous disciplines, extending far beyond neurology and neurosurgery. A solid understanding, often gained through comprehensive textbooks and accessible PDF resources, is crucial for diagnosing and treating neurological disorders. Resources like those mentioned in connection with the JNS (Journal of Neurosurgery) highlight this need.

Furthermore, it’s foundational for advancing our understanding of behavior, cognition, and consciousness. Detailed anatomical knowledge, as presented in resources like Netter’s Atlas of Human Anatomy, allows researchers to correlate structure with function, leading to breakthroughs in fields like psychology and artificial intelligence.

The field’s importance is underscored by the continuous updates in neuroscience, reflected in resources like “Brain Facts” and publications from Nobel Publishing. Understanding the brain’s vascular supply, as detailed in various anatomy resources, is vital for surgical planning and patient care. It’s a dynamic field, essential for improving human health and well-being.

Major Brain Regions

Brain regions – cerebrum, cerebellum, and brainstem – are meticulously detailed in anatomy PDF guides and textbooks.

Understanding their structure is key to neurological function.

Cerebrum: Structure and Function

The cerebrum, the largest part of the human brain, is extensively covered in anatomy PDF resources and detailed textbooks like those by Netter. Its structure is characterized by two hemispheres, connected by the corpus callosum, and a highly convoluted cortex maximizing surface area.

This intricate folding creates gyri (ridges) and sulci (grooves), crucial for increased neural processing capacity. The cerebral cortex, composed of grey matter, is responsible for higher-level cognitive functions. Beneath lies white matter, facilitating communication between different brain regions.

Functionally, the cerebrum governs voluntary movement, sensory perception, learning, memory, and language. Detailed anatomical studies, often found in downloadable PDF formats, emphasize the importance of understanding these structural components to comprehend complex cognitive processes. Resources highlight the cerebrum’s role in interpreting sensory input and formulating appropriate responses.

Cerebellum: Coordination and Motor Control

The cerebellum, often detailed in brain anatomy PDF guides and comprehensive textbooks, plays a vital role in coordinating movement and maintaining balance. Though smaller than the cerebrum, its intricate structure – featuring folia, fissures, and deep cerebellar nuclei – is crucial for motor control.

Resources emphasize that the cerebellum doesn’t initiate movement, but rather refines it, ensuring smoothness and accuracy. It receives sensory input from the spinal cord and other brain regions, comparing intended movements with actual performance and making necessary adjustments.

Anatomy studies, readily available as downloadable PDFs, illustrate the cerebellum’s layered cortex and its connections to motor pathways. Damage to the cerebellum results in ataxia – a lack of coordination – highlighting its essential function. Understanding its structure, as depicted in anatomical atlases, is key to grasping its role in motor learning and adaptation.

Brainstem: Vital Functions

The brainstem, meticulously illustrated in brain anatomy PDF resources and detailed textbooks, is a critical structure responsible for numerous vital functions. Connecting the cerebrum and cerebellum to the spinal cord, it controls essential processes like breathing, heart rate, and blood pressure.

Anatomy guides emphasize the brainstem’s three main components: the midbrain, pons, and medulla oblongata. Each region contains nuclei and pathways governing specific functions. For example, the medulla regulates respiration, while the pons relays signals between the cerebrum and cerebellum.

Downloadable PDFs often showcase the cranial nerves originating from the brainstem, controlling facial sensation, eye movement, and swallowing. Damage to this area can be life-threatening, underscoring its importance. Studying its complex circuitry, as presented in anatomical atlases, is fundamental to understanding neurological control.

Lobes of the Cerebral Cortex

Cerebral cortex lobes – frontal, parietal, temporal, and occipital – are extensively detailed in brain anatomy PDFs and textbooks.

These lobes exhibit specialized functions, crucial for understanding neurological processes.

Frontal Lobe: Executive Functions

The frontal lobe, meticulously illustrated in brain anatomy PDFs and comprehensive textbooks like Netter’s Atlas of Human Anatomy, represents the largest lobe of the cerebral cortex and is pivotal in higher-order cognitive processes. It’s responsible for a suite of “executive functions” essential for goal-directed behavior.

These functions encompass planning, decision-making, working memory, impulse control, and abstract thought. The prefrontal cortex, a key component of the frontal lobe, plays a critical role in personality expression and social behavior. Damage to this area can result in significant alterations in personality and impaired judgment.

Detailed anatomical studies, often found in neurosurgical resources and online databases, reveal intricate connections within the frontal lobe and its interactions with other brain regions. Understanding the precise anatomical organization is crucial for diagnosing and treating conditions affecting executive functions, such as traumatic brain injury or frontotemporal dementia.

Parietal Lobe: Sensory Processing

The parietal lobe, extensively detailed in brain anatomy resources including PDF atlases and medical textbooks, is a central hub for processing sensory information from across the body. It integrates somatosensory input – touch, temperature, pain, and pressure – to construct a coherent perception of our physical environment.

This lobe is also crucial for spatial awareness, navigation, and proprioception (the sense of body position). Anatomical studies, like those found in specialized neurosurgical literature, demonstrate the parietal lobe’s intricate organization into distinct areas responsible for specific sensory functions.

Damage to the parietal lobe can lead to a variety of sensory deficits, including astereognosis (inability to identify objects by touch) and neglect syndrome (inability to attend to one side of space). Detailed anatomy, often visualized in brain imaging studies, is vital for understanding these clinical presentations and guiding treatment strategies.

Temporal Lobe: Memory and Audition

The temporal lobe, thoroughly illustrated in brain anatomy PDF resources and comprehensive textbooks like Netter’s Atlas of Human Anatomy, plays a pivotal role in auditory processing, memory formation, and language comprehension. It receives auditory information from the ears, enabling us to perceive and interpret sounds.

Crucially, the temporal lobe houses the hippocampus and amygdala, structures essential for forming new long-term memories and processing emotions, respectively. Detailed anatomical studies reveal the intricate connections between these structures and other brain regions.

Damage to the temporal lobe can result in amnesia, difficulty recognizing objects, or impaired language skills. Understanding the precise anatomical organization, often visualized through neuroimaging, is critical for diagnosing and managing neurological disorders affecting memory and auditory function. Resources like “Brain Biochemistry and its Disease” further illuminate these complexities.

Occipital Lobe: Visual Processing

The occipital lobe, meticulously detailed in brain anatomy PDF guides and foundational textbooks such as Netter’s Atlas of Human Anatomy, is the primary visual processing center of the brain. It receives visual information directly from the eyes and interprets it, allowing us to perceive shapes, colors, and motion.

This lobe contains several specialized areas, including the primary visual cortex, responsible for initial processing, and higher-level visual areas involved in object recognition and spatial awareness. Anatomical studies, often aided by neuroimaging, reveal the hierarchical organization of visual processing within the occipital lobe.

Damage to this region can lead to various visual deficits, ranging from blindness to difficulties recognizing objects or perceiving depth. Resources like “Brain Biochemistry and its Disease” provide insights into the molecular mechanisms underlying visual function and dysfunction. Understanding its anatomy is vital for neurological diagnosis.

Detailed Anatomical Structures

Brain anatomy PDF resources and textbooks, like Netter’s Atlas, illustrate neurons, synapses, and the distinction between grey and white matter.

These structures are fundamental to understanding brain function.

Neurons: The Basic Units

Neurons are the fundamental building blocks of the nervous system, and their intricate structure is meticulously detailed in brain anatomy PDF resources and comprehensive textbooks. These specialized cells are responsible for receiving, processing, and transmitting information throughout the brain and body.

A typical neuron consists of a cell body (soma), dendrites, and an axon. Dendrites are branching extensions that receive signals from other neurons, while the axon transmits signals to other neurons, muscles, or glands. The axon is often covered in a myelin sheath, a fatty substance that insulates the axon and speeds up signal transmission.

Understanding neuronal structure is paramount when studying brain anatomy. Resources like Netter’s Atlas of Human Anatomy provide detailed illustrations of various neuron types and their components. The study of neurons is essential for comprehending how the brain functions, learns, and adapts. Further exploration can be found in specialized neuroscience books and online databases.

Synapses: Communication Between Neurons

Synapses are the critical junctions where communication occurs between neurons, a process central to understanding brain anatomy as detailed in numerous PDF resources and textbooks. This communication isn’t physical; rather, it’s a chemical transmission of signals.

When an electrical signal reaches the end of an axon, it triggers the release of neurotransmitters into the synaptic cleft – the tiny gap between neurons. These neurotransmitters bind to receptors on the receiving neuron’s dendrites, initiating a new electrical signal. This complex process is fundamental to all brain functions.

Different types of synapses exist, influencing the strength and speed of communication. Studying synaptic plasticity – the ability of synapses to strengthen or weaken over time – is crucial for understanding learning and memory. Resources like specialized neuroscience books and online databases offer in-depth exploration of synaptic function and its role in brain anatomy.

Grey Matter vs. White Matter

Grey matter and white matter are the two primary components of the central nervous system, distinctly visualized in brain anatomy PDF resources and textbooks like Netter’s Atlas of Human Anatomy. Grey matter, appearing darker, is rich in neuronal cell bodies, dendrites, and synapses – the sites of information processing.

Conversely, white matter gets its color from myelin, a fatty substance insulating nerve fibers (axons). This myelin sheath enables faster signal transmission over longer distances. White matter primarily connects different grey matter areas, facilitating communication throughout the brain.

The distribution of grey and white matter varies across brain regions. The cerebral cortex is largely grey matter, while deeper structures contain more white matter. Understanding this distinction is vital for interpreting brain scans and comprehending neurological function, as detailed in specialized neuroscience books and online databases.

Vascular Supply of the Brain

Brain vasculature, detailed in anatomy PDFs, relies on major arteries. Understanding arterial pathways, like those illustrated in Netter’s Atlas, is vital for neurological study.

The blood-brain barrier protects the brain, a topic covered in neuroscience textbooks.

Major Arteries Supplying the Brain

Brain arterial supply, comprehensively detailed in anatomy PDF resources and illustrated within Netter’s Atlas of Human Anatomy, is fundamentally crucial for neurological function. The internal carotid arteries and vertebral arteries are the primary contributors, forming the Circle of Willis – a critical anastomosis at the base of the brain.

The internal carotids deliver blood to the anterior circulation, supplying the cerebral hemispheres via the anterior cerebral artery (ACA) and middle cerebral artery (MCA). These arteries are vital for regions governing motor function, sensory perception, and language. The vertebral arteries, conversely, contribute to the posterior circulation, merging to form the basilar artery.

The basilar artery then branches into the posterior cerebral arteries (PCA), supplying the occipital lobe (visual processing) and parts of the temporal lobe. Precise understanding of these arterial distributions, often found in specialized textbooks, is essential for diagnosing and treating cerebrovascular events. Variations in anatomy, as noted in research papers, necessitate careful consideration;

Blood-Brain Barrier

The blood-brain barrier (BBB), a highly selective permeability barrier, is a cornerstone of brain anatomy, extensively documented in neuroscience PDFs and textbooks. It safeguards the delicate neural environment from toxins and pathogens while facilitating essential nutrient transport.

Structurally, the BBB is formed by tightly joined endothelial cells lining the cerebral capillaries, supported by astrocytes, pericytes, and the basement membrane. These components restrict paracellular diffusion, limiting the passage of many substances. Specialized transport systems, however, allow for the regulated entry of glucose, amino acids, and other vital molecules.

Understanding the BBB’s function, as detailed in resources like “Brain Biochemistry and its Disease”, is crucial for comprehending drug delivery to the brain and the pathophysiology of neurological disorders. Disruptions to the BBB can contribute to inflammation and neurodegeneration, highlighting its critical role in maintaining brain homeostasis.

Resources for Studying Brain Anatomy

Numerous textbooks, like Netter’s Atlas, and freely available PDFs offer detailed brain anatomy insights; Online resources and atlases further enhance learning.

Explore sites like ct2tee.agh.edu.pl for simulators and JNS publications for focused study.

Textbooks on Brain Anatomy

Textbooks remain foundational for mastering brain anatomy, providing structured learning and detailed illustrations. A cornerstone in the field is Ernest Netter’s Atlas of Human Anatomy, renowned for its comprehensive coverage of gross anatomy and clear visual representations. This atlas serves as an invaluable resource for students and professionals alike, offering a detailed exploration of the brain’s structures.

Beyond Netter, various physiology textbooks incorporate substantial sections on neuroanatomy, offering a functional context alongside structural details. Many of these resources are available in PDF format for convenient access and study. Older texts, while potentially lacking the latest advancements, can still provide a solid base understanding, sometimes available for download.

When selecting a textbook, consider your learning style and the level of detail required. Some books focus on surface anatomy, while others delve into intricate microscopic structures. Digital versions, often in PDF, allow for easy searching and annotation, enhancing the learning experience. Remember to supplement textbook study with atlases and online resources for a well-rounded understanding.

Online Brain Anatomy Resources & PDFs

The internet offers a wealth of brain anatomy resources, complementing traditional textbooks. Numerous websites provide interactive 3D models, labeled diagrams, and detailed explanations of brain structures. Many universities and institutions make lecture notes and course materials, often in PDF format, publicly available, offering valuable supplementary learning tools.

Specific resources, like those linked in research papers (e.g., referencing JNS publications), provide focused anatomical information. Searching for “brain anatomy PDF” yields a variety of downloadable materials, including study guides and atlas excerpts. However, critically evaluate the source’s credibility before relying on online PDFs.

Online simulators, such as the TEE Online Simulator mentioned in relation to atrial appendage anatomy, demonstrate anatomical relationships in a dynamic way. The “Brain Facts book” website is frequently updated with current neuroscience information. Utilizing these digital resources alongside physical textbooks provides a comprehensive and flexible learning experience.

Atlases of Brain Anatomy

Atlases of Brain Anatomy are indispensable tools for visualizing and understanding the complex structures of the nervous system. Netter’s Atlas of Human Anatomy stands out as a foundational resource, renowned for its clear illustrations and comprehensive coverage. These atlases often include detailed depictions of surface anatomy, cross-sections, and vascular supply.

While physical atlases remain valuable, digital versions and accompanying PDF resources are increasingly common. These digital formats often allow for interactive exploration, zooming, and labeling of structures. Many atlases correlate anatomical images with functional organization, aiding in comprehension.

Access to high-quality anatomical images is crucial, and several online platforms offer digitized atlas content. Researchers frequently cite specific atlas plates in publications, demonstrating their importance in scientific communication. Combining atlas study with other resources, like textbooks and online models, provides a robust learning experience for students and professionals alike.